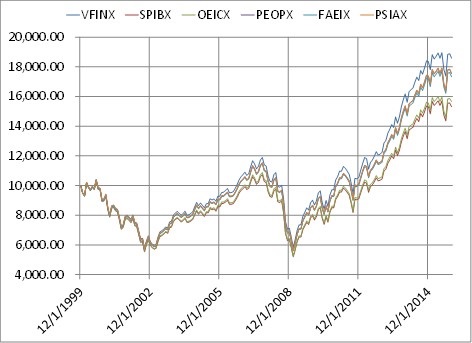

In recent months, I’ve looked at whether it matters which actively managed funds you invest with. The answer was an emphatic yes. There is a world of performance difference between managed funds even in the same investment style like small cap or large cap. In this article, the question to answer is whether it matters which passively managed index fund you use? The answer might surprise you. After all, these all invest in the same funds. The chart below will help to see clearly that the answer over time is yes, it makes a substantial difference.

The chart compares the results of six funds that invest in the same stocks with the same passive index strategy. They all seek to mimic the return of the S&P 500 before fees and expenses. The six funds compared are VFINX is Vanguard Index Fund 500, investor class, SPIBX is Invesco S&P 500 Index Fund, class B, OEICX is JP Morgan Equity Index Fund, class C, PEOPX is Dreyfus S&P 500 Index Fund, FAEIX is Nuveen Equity Index Fund, class A, and PSIAX is Prudential QMA Stock Index Fund.

Each of the six fund positions started with $10,000 on 12/31/1999. This was right about the peak of the index craze and tech bubble. It would take until 2013 or about 14 years later to actually make money using a passive index fund with a buy and hold strategy, but that is a different story.

By year end 2015, each fund was up after 16 years to above $15,000 for a 50% gain, but the best fund gained $8,588, while the worst fund gained $5,312. That is a 62% difference.

Results do not include any contributions or withdrawals over the months. It does include dividends reinvested.

It was the same starting value at the same time, the same strategy, and the same index yet the end difference is striking! If you had started with $1,000,000, the difference would be $327,000.

So, what accounts for the vast difference in results? Fees and expenses matter. Clearly the higher the fees you incur in your fund, the less return that nets to the shareholder.

Another issue is called tracking error. It is the difference between what one buys or sells a stock for versus what the market is at the time of the trades. Size will move the market, but it can also help to maintain the market.

Just like it matters which active fund you use, the passive index fund that you may also use will matter to your future wealth.