Last month I talked about if it mattered whether you invest in high or low cost index funds. The answer was yes, it does. If you are a buy and hold index investor, then you want the lowest cost provider. But what happens if you already invest in index funds whose expense ratios are the lowest in the industry at 0.05% and 0.16%? Will that make much of a difference? It too will matter, but it will take a substantially larger investment and a longer duration (holding period) to make a meaningful difference to your nest egg.

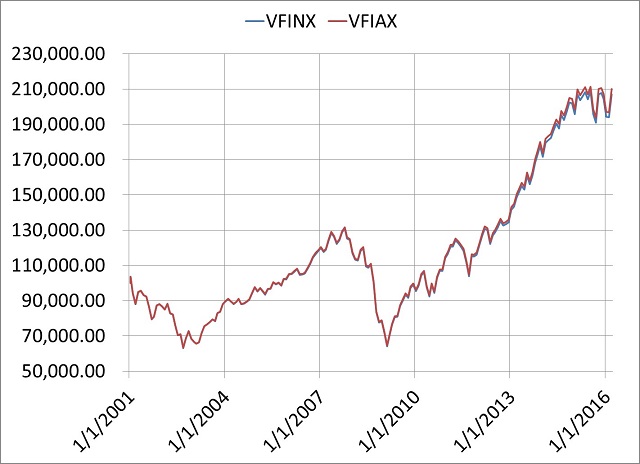

The chart below shows this. Last month I assumed a $10,000 starting value (View My April Blog Discussion Here) . This month I assume a $100,000 start invested into two index funds from Vanguard on 12/31/2000 and held through 3/31/16. Dividends were reinvested. The two funds both attempt to mimic the S&P 500 before fees. The funds respectively are Vanguard Index 500 (retail) VFINX and Vanguard Index 500 Admiral VFIAX.

If you can’t see much of a difference, it is because there isn’t much of a difference. As might be expected, the fund with the lowest fee did end up with more than the fund with the higher fee. VFIAX grew to $210,094. VFINX ended at $207,076. This of course will continue to widen over time.

The minimum investment into VFINX is $3,000. For VFIAX, it is $10,000.

Vanguard also provides an ETF that has an expense ratio of 0.05% with no minimum requirement. It is VOO. So I also compared VOO and VFIAX, which both have the same expense ratio. The numbers should end up the same, right? Not exactly and the reason would be miniscule tracking errors between the funds and the S&P 500. VOO began about 9/30/2010. From that point until 3/31/2016, VOO grew to $209,896, while VFIAX grew to $210,094. That’s a practically meaningless difference of about $200 over 5 ½ years or $3 per month.

If you are an index fund buy and hold investor, then you clearly want to own the low cost provider in this space.

PS It will be interesting to see how 401k plan providers use this information as their plan fiduciaries. Let 401kSelections.com help your company find the lowest cost provider!